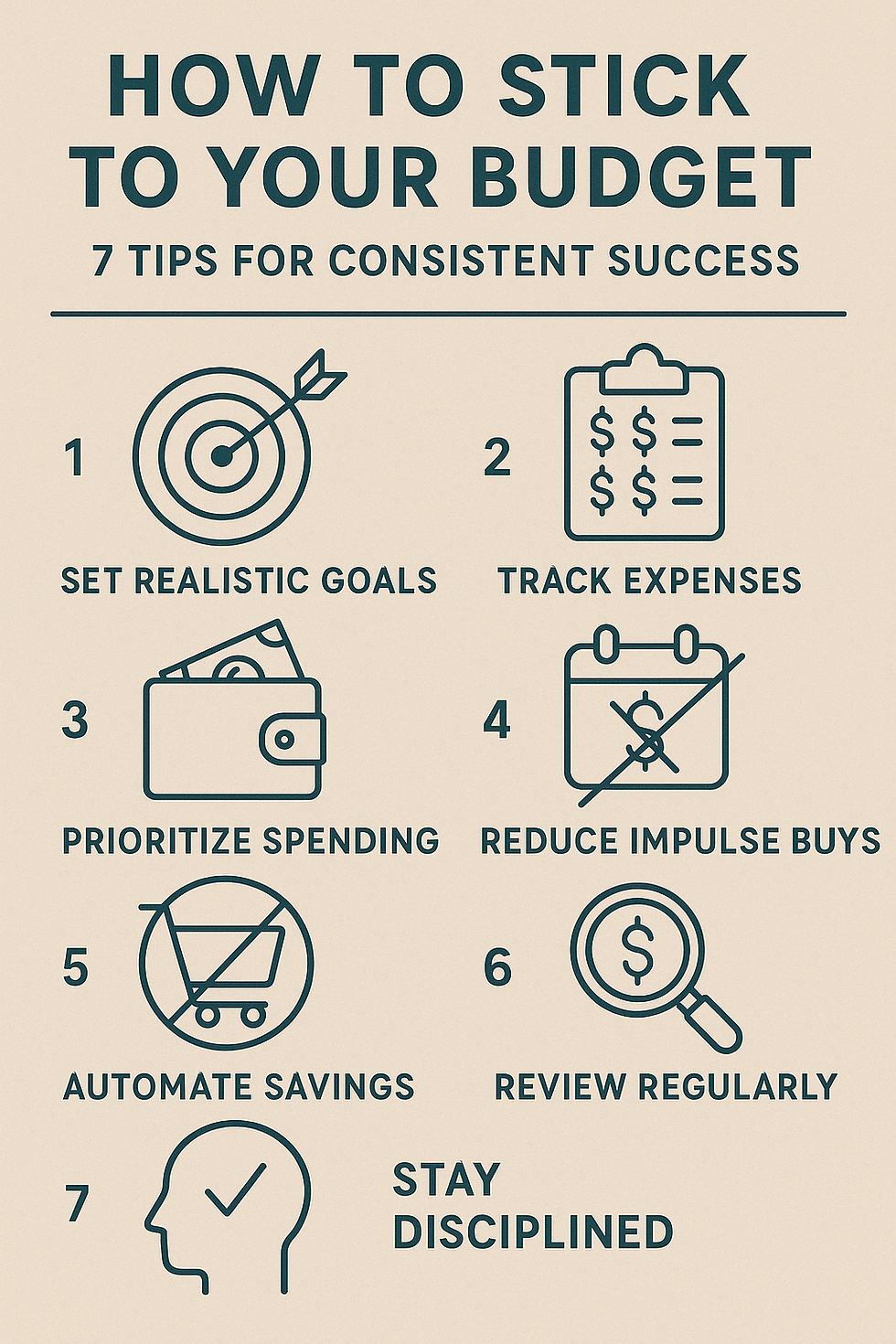

How to Stick to Your Budget: 7 Tips for Consistent Success

- jamie Budd

- Jun 30

- 9 min read

Budgeting helps you control your money instead of letting money control you. But sticking to a budget can be hard. Many people promise to save money, then splurge on something they don’t need. In fact, about 3 out of 4 Americans don’t stick to a budget regularly. This can lead to money stress and feeling out of control. As personal finance expert Dave Ramsey says, “You must gain control over your money, or the lack of it will forever control you.”

The good news: anyone can learn to budget successfully with the right steps. A budget is just a plan for how to spend your money each month. It’s not about math skills or giving up all the fun in life. It’s about making sure you have enough for what you need and care about. This guide will explain why budgeting matters, common challenges, and 7 simple tips (with stories and quotes) to help you stick to your budget. Let’s get started with why budgeting is so important.

Why Budgeting Is Important

Gives You Control: With a budget, you decide exactly where your money goes. You won’t panic about running out of money because you have a plan.

Helps You Save: A budget makes it easier to save for goals like a new phone, college, or a car. It’s like a roadmap to reach your dreams.

Prepares You for Emergencies: Budgeting lets you build an emergency fund for unexpected costs (like car repairs or medical bills). Sadly, almost 60% of Americans can’t cover a $1,000 emergency. With a budget, you can avoid that stress by saving a little each month.

Prevents Waste: Tracking your money helps you spot and stop wasteful spending. Remember, “A small leak will sink a great ship,” so plugging those leaks means more money for things that matter.

Common Budgeting Challenges

Feeling Limited: Some people think a budget means no fun. If your budget is too strict, you might feel unhappy and want to quit.

Surprise Expenses: Unplanned costs (like car fixes or doctor visits) can mess up your plan if you haven’t prepared for them.

Impulse Buys: It’s easy to buy things on a whim. Those surprise purchases can blow your budget if you’re not careful.

Losing Steam: Budgeting is a habit that takes time. It’s common to start strong and then fade if you don’t stay motivated.

No Tracking: If you don’t watch where your money goes, it’s easy to overspend without noticing.

These challenges are normal. Next, we’ll look at 7 tips to overcome them and budget successfully.

Tip 1: Set a Goal and Create a Simple Budget Plan

Know your “why.” The first step is knowing why you’re budgeting. What’s your goal? Maybe you want to save $500 for emergencies, pay off a credit card, or buy something special. A clear goal gives you a reason to follow your budget, even when it’s tough.

Personal Story: For example, Lucy, a student, wanted a new laptop. She realized she spent $10 a week on snacks. She decided to save $5 each week instead. In a few months, Lucy saved enough for her laptop. Whenever she was tempted to overspend, she remembered her goal and stuck to her plan.

Make a simple plan. Write down how much money you get each month (income) and how much you spend (expenses). Expenses include everything you pay for – like rent, food, transportation, and fun. Make sure your expenses are not more than your income. If they are, adjust by cutting back on less important things or finding ways to earn a bit more.

One popular guideline is the 50/30/20 rule: use 50% of your income for needs (must-haves), 30% for wants (extras), and 20% for savings or debt. This ensures you cover essentials, enjoy a little, and still save each month.

Finally, write down your budget in a way that’s easy to follow (on paper or in a notes app). Now you have a clear plan for your money. As one saying goes, “A budget is telling your money where to go instead of wondering where it went.” With a realistic budget tied to your personal goal, you’ll be motivated to stick with it.

Tip 2: Track Every Expense (Even the Small Ones)

After you have a budget, the next step is to track your spending. Keep a record of every dollar you spend. It might sound tedious, but it’s important. If you don’t track, you might overspend without realizing.

Personal Story: James, a college freshman, felt short on cash even though he had a budget. He decided to track every expense for one month. James was shocked to find he was spending about $50 a month on vending machine snacks and fancy coffees! By cutting down those extras and writing down everything he spent, James saved money and felt more in control.

How to track: Choose a method that works for you:

Carry a small notebook and jot down what you buy.

Keep receipts and total them each day.

Use a notes app or budgeting app to log expenses as you go.

Whichever method you use, be consistent. If you buy a $2 snack, write it down. If you pay a bill, mark it down. Every expense counts. You may be surprised how small expenses add up over time. Tracking shines a light on your habits and shows exactly where your money goes. Then you can spot problems and adjust your spending before you get too far off track.

Tip 3: Use Budgeting Tools and Templates to Make It Easier

You don’t have to budget with just a pen and paper (unless you want to!). There are many tools and apps that can help you manage your money. Using a tool can save time and help you stay organized.

Personal Story: Ayesha often forgot to write down her spending and found budgeting confusing. She started using a free budgeting app on her phone that linked to her bank account and automatically tracked her expenses. She also used a printable budget checklist to mark off each bill as she paid it. With these helpers, budgeting became much easier for her.

Here are a couple of popular budgeting tools you can try:

Budgeting Apps: Apps like Mint connect to your bank and automatically categorize your expenses. Another popular app, You Need A Budget (YNAB), helps you assign every dollar a job (like a digital envelope system). These apps can even alert you when you’re nearing your limit in a category.

Spreadsheets or Templates: If you like using Excel or Google Sheets (or pen and paper), you can budget that way too. You can find free budget templates online to fill in with your income and expenses. A simple budget worksheet (on the computer or printed out) lets you see your whole plan at a glance.

Using the right tool can take a lot of stress out of budgeting. For example, an app can do the math for you and record transactions automatically, so you’re less likely to forget things. Templates and checklists keep your plan neat and clear. In short, a good budgeting tool is like a helpful coach that keeps you on track.

Tip 4: Budget for Fun and Flexibility

Believe it or not, a good budget includes some fun! If your budget is all bills and no enjoyment, it’s like a diet with no treats – you’re likely to give up. It’s important to allow yourself a little spending money for things that make you happy. This is often called “fun money” or a flexible spending category.

Personal Story: Carlos tried a super strict budget right after college. He only allowed himself to spend on rent, utilities, and groceries – nothing else. It worked for a few weeks, but he felt miserable watching his friends go out while he stayed home. Eventually, he snapped and went on a weekend shopping spree, spending $200 and blowing his budget. After that, Carlos realized his budget was too restrictive. He restarted with a new plan that included a “fun” category of $50 a month for treats like eating out or a new book. With a little room for fun, he stopped feeling so deprived and was able to stick to his budget consistently.

Financial experts agree that budgets shouldn’t be too strict. If you never allow any enjoyment, you might end up with so much pent-up desire that you go on a big spending binge. “Who wants to stay involved with a plan that is all work and no play?” one planner wisely asked. In other words, include some fun in your budget to make it sustainable.

So, give yourself permission to spend a small amount each month on something you enjoy. It could be $20 for a couple of takeout meals, or $15 for a movie or new book – whatever fits your budget and brings you joy. By budgeting a little “fun money,” you create a balanced plan that you can live with long-term. You’ll enjoy life while still being responsible with your money, which means you won’t feel the urge to abandon your budget.

Tip 5: Expect the Unexpected (Build an Emergency Fund)

Part of sticking to your budget is accepting that life is unpredictable. Cars need repairs, pets get sick, or you might get an unexpected bill. These surprises can mess up your budget if you haven’t prepared for them. That’s why it’s important to set aside a little money for emergencies.

Personal Story: Mia was doing well with her budget until her car’s battery died, costing her $150. She hadn’t planned for that, so she had to put it on a credit card and it wrecked her budget for the month. After that, Mia decided to save $25 per month for emergencies. In a year, she saved $300. Later, when her car needed new brakes, Mia used her emergency fund and kept her budget intact. She was so relieved that she had prepared for the unexpected.

Build an emergency fund: Try to save a small amount each month specifically for surprises. Even $10 or $20 helps. To make sure you save, pay yourself first – put money into savings right when you get paid, before you spend on other things. (As investor Warren Buffett advised, “Do not save what is left after spending, but spend what is left after saving.”) Over time, aim for 3–6 months’ worth of expenses in savings. Having even a few hundred dollars set aside can protect you from going into debt when something unexpected happens.

By planning ahead for emergencies, you won’t have to abandon your entire budget when a surprise expense comes up. You’ll have a safety net to handle it, which keeps your finances on track and gives you peace of mind.

Tip 6: Review and Adjust Your Budget Regularly

A budget isn’t a “set it and forget it” thing – it’s a living plan. Life changes, and your budget should change with it. Maybe you got a pay raise, or your rent went up, or groceries cost more than you expected. To stick to your budget, get in the habit of checking and updating it regularly.

Personal Story: Ella never updated her budget after she first made it. Over the year, some bills went up and she added a gym membership, but her budget stayed the same. Soon it didn’t fit her life at all. Finally, Ella started doing a monthly budget review. At the end of each month, she compared her plan with what actually happened and made changes. For example, when her grocery spending kept going over budget, she increased that amount and cut back in another area. By adjusting her budget regularly, it stayed realistic and helpful.

Check in and adjust: Try to review your budget at least once a month. Look at where you stayed on track and where you overspent. Then adjust your plan for the next month. If you spent too much in one category and less in another, move some money around so the plan fits reality. Don’t think you “failed” because you had to change your budget – that’s normal! In fact, updating your budget is part of successful budgeting. A budget is there to help you, not to punish you, so fix it as needed. By doing these regular check-ins, you’ll keep your budget working for your life.

Tip 7: Stay Motivated and Celebrate Small Wins

Sticking to a budget is a long-term journey, so it’s important to keep yourself motivated. Find ways to make budgeting rewarding so you don’t lose steam over time.

Personal Story: Raj had $5,000 of credit card debt to pay off. He knew it would take many months of budgeting, so he found ways to stay excited. Raj broke his big goal into smaller steps. For every $1,000 he paid off, he gave himself a small reward (like a picnic in the park or a movie night at home). He also drew a chart and colored in sections as he paid off each chunk of debt. These little rewards and visual trackers kept him motivated. After several months, Raj paid off all $5,000! Celebrating the small wins helped him reach a big goal.

Keep Your Goal in Sight: Put up a picture of what you’re saving for or a chart of your progress. Seeing your goal daily will inspire you.

Reward Yourself: When you hit a milestone, treat yourself to something small (like an ice cream or a new library book). Celebrating progress makes budgeting more fun.

Stay Positive: Everyone makes money mistakes sometimes. If you overspend this month, start fresh next month. Every good choice – even skipping an impulse buy – is a win that adds up over time.

Conclusion

Sticking to your budget gets easier with practice. We’ve covered why budgeting matters and shared 7 tips to help you succeed. Remember, you’re not alone if it feels challenging – many people struggle at first. The important thing is to start with small steps and keep at it. Every little action, like writing down an expense or saving a few dollars, is progress.

Over time, these small habits become routine, and you’ll see your finances improve. You’ll start reaching your goals and gain peace of mind knowing you’re in control of your money. Instead of money controlling you, you will be controlling your money. With consistency and the tips above, you can build a brighter financial future. You’ve got this – happy budgeting!

Comments